Fab Feb - Finance

✅Fitness - #28bysamwood 'Beyond the Mat'

✅Free of Alcohol

✅Finance

It has taken 57 days from my original appointment with the bank to

today to secure finance for our new house. It has taken 47 days from the

pre-approval offer of finance on the day we signed the contract to our new

house (waiving our cooling-off period) to today’s signed mortgage agreement for

a significantly lower amount. We are extremely grateful that the owner of our

new house wanted a long settlement and that we are in a position where we can

call upon help to meet the shortfall in funds, embarrassing though. We are also

very fortunate to have bought a house a year after selling our previous home. This

year of a falling residential property market in Sydney (and elsewhere) has

allowed us to buy a house reasonably close to where we already are, instead of following

our original plans of moving much further out.

Yet, we could not have been looking for finance at a worse time in

recent history. It used to be so easy when we were on double income and banks believed

the low spending one reported. According to the banks I have zero annual income,

since I am currently a casual teacher who hasn’t worked since October. It doesn’t

matter that I was travelling and Christmas holidays occurred in the meantime.

According to most banks, scholarship money doesn’t count as income, but then that

turned out to be a blessing since I didn’t retain it for the PhD anyway. Also,

unless I have filed a tax return for the respective period, my business income

doesn’t count since it could have expenses against it that result in a loss. As

a result of all this, our mortgage application had to rely solely on John’s

income.

On the expense side of the equation, the Royal Commission into Misconductin the Banking, Superannuation and Financial Services Industry has changed the

methods and madness of mortgage lending to now apply a microscope to bank and

credit card statements. We knew this ahead of time and kept to a very strict

budget for over three months to demonstrate our restraint. It wasn’t enough. A

couple of weeks ago the bank asked for six months of our statements, meaning the

last hoorah of spending that occurred just before our self-imposed recession, revealed

us as irresponsible rampaging revellers. To secure our much reduced mortgage we

had to cut-up all our credit cards! Since we had warning of that impending

disaster, we spent all the accumulated reward points on a large screen TV, a

sound bar, a microwave oven, a frypan, a slow cooker, a stick blender, a dust

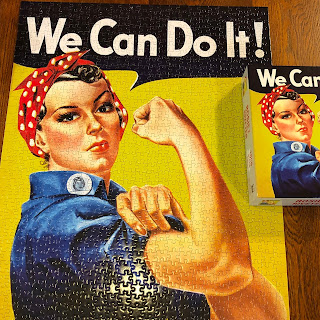

buster, gift cards to Barbeques Galore and Myer, and a jigsaw puzzle. Of course

it would have been more financially effective to transfer the points to Velocity

frequent flyer points, if only we were intending to travel soon. Not on the

cards.

I actually think some of the changes in lending practices are

appropriate for safe lending by the banks. We have quite a good financial

system in Australia due to its regulatory practices but regulations haven’t

kept up with the consolidation of the various arms of the financial industry

and the increasingly creative ways of lending and earning fees on financial

products. However, as our Home Finance Manager kept trying to argue on our

behalf, credit managers should be looking at the person, not just the numbers.

It is quite obvious that I have a reasonable earning capacity at the moment,

even if the last three months show no steady income from a consistent source.

At the end of my PhD there’s a high likelihood I will return to a good solid

income, possibly higher than it was before, but that’s not included in the

assessment process. It is also clear that our ability to spend up last year was

due to access to the funds from selling a house, enabling my trip to Europe that

would otherwise not have occurred. I’m hoping that a sensible balance of facts

and figures with humans and hearts will be found one day.

For now, the finance fight is behind us. A few months down the

track, when I have a good recent record of casual teaching, we will apply for a

top-up of our loan. Then, when I return to full-time income, the goal is to install

an infinity pool (exactly like the one in the hyperlink). Plans. I always have plans.

P.S. Our bank shares went up 7% yesterday. The stock market influencers

obviously expected a more damning report from the Royal Commission: “All you need to know is that when the report came out…bank shares went up.”

Comments